Sabancı Group Implements Pioneering And Exemplary Practices To Achieve Its Sustainability Goals

- Sabancı Holding is the first holding company in Türkiye to announce Net Zero Emissions target by 2050.

- We have committed to a 15% reduction in Scope 1 & 2 GHG emissions by 2025 and a 42% reduction by 2030 versus 2021 baseline without using carbon offsets.

- We are the first holding company to embed sustainability criteria into our capital allocation criteria.

- Our efforts expanded to a comprehensive nature program, employing both an outside-in and inside-out approach. Sabancı Holding’s Nature Agenda includes Decarbonization Initiatives Water Management, Biodiversity and Circular Economy.

- Best ambition level in SBTi: Sabancı Holding’s target is aligned with 1.5°C pathway of the globally recognized Science Based Targets initiative (SBTi).

- 100% of material technologies companies

- 100% of mobility solutions companies are aligned with the SBTi 1.5°C pathway.

| | 2020 | 2021 | 2022 | 2023 | 2030 | 2050 |

|---|

| Decarbonization |

| GHG emissions (Scope 1+2, Mt)* |

10.10 |

11.20 |

9.95 |

8.94 |

6.49 |

Net Zero |

| GHG emissions (Scope 3, Mt) CO2-free |

11.21 |

11.59 |

10.29 |

9.37 |

6.72 |

Net Zero |

| Renewables |

| Renewable Electricity Usage** |

- |

- |

27% |

54% |

≥80% |

- |

| CO2-free energy production*** |

42% |

43.7% |

|

|

75% |

100% |

| Circularity |

Circularity KPIs to be published 2025 onwards |

| Total waste (ton)**** |

31,574 |

42,762 |

52,445 |

180,357 |

Achieving circular inflow targets**** |

Achieving circular design and outflow targets**** |

| Total recycled/reused (%)**** |

87% |

80% |

78% |

29% |

*Sabancı Holding’s GHG emissions have been calculated by using the equity share approach in accordance with the Greenhouse Gas Protocol. Accordingly, Sabancı Holding accounts for GHG emissi ons from operations according to its share of equity in the operation.

** Assumptions based on analysis conducted in 2023.

*** Installed capacity.

**** Total waste increase mainly attributable to increase in n on-hazardous waste of Carrefoursa.

Our Responsible Investment Strategy Intersects With Both Our Nature And Social Agendas

- We are the first holding company to issue a Responsible Investment Policy.

- 2023 marked the generation of our pilot green hydrogen in Türkiye’s first Hydrogen Valley.

- Our CO2-free energy generation rate will reach 78.5% by 2030.

- By 2027, our cumulative SDG-linked investments will reach USD 5 billion. We are conducting R&D studies to expand our SDG-linked portfolio and constantly innovating and exploring future growth opportunities. In 2023, X% of overall Sabancı Group R&D and innovation activities have been served to the SDG-linked activities.

- We are developing Türkiye’s first inter-city hydrogen bus following the launch of Europe’s first intercity electric bus.

- Our renewables portfolio will reach 3 GW+ by 2026 including the largest onshore wind energy project in Europe.

- Sabancı Group operates Türkiye’s largest electric vehicle high speed charging station network.

- A member of the Net-Zero Banking Allience, Akbank sets ambitious targets, aiming to become a Net Zero Bank by 2050. The Banks exceeded its TL 200 billion Sustainable Financing goal for 2030 by the end of 2023 with TL 226 billion and raised it to TL 800 billion.

- Akbank is committed increasing the sustainable investment fund balance to TL 15 billion in Assets under Management by 2030.

| | 2020 | 2021 | 2022 | 2023 | 2030 |

|---|

| Sustainable Finance |

| TL 200 billion Sustainable Finance Pledge* |

8.2% |

13.5% |

30% |

113% |

Exceeded target with TL 226 bn in 2023 and raised Sustainable Finance Pledge to TL 800 bn 6.72 |

| 15 billion TL sustainable investment funds balance |

- |

- |

- |

21% |

| Responsible Investment |

| Ratio of SDG-linked R&D and innovation investments |

44% |

51% |

53% |

83% |

≥70% |

| USD 5 bn SDG-related investment Pledge |

- |

- |

10% |

22% |

100% |

* Committed by Akbank, in addition to their sustainable investment funds commitment reaching TL 15 billion until 2030. The tar get has already been exceeded in 2023.

Akbank has established a new target which is amounting TL 800 bn Sustainable Finance Pledge until 2030.

We Keep Diversity, Equity And Inclusion At The Core Of Our Social Agenda.

- Sabancı Holding has implemented specific quotas to promote gender equality.

The Holding has achieved equal pay for equal work and established a 50% women quota in all development programs, along with a 30% women quota in the Senior Management recruitment shortlist.

These quotas are part of its broader goals of enhancing gender diversity and inclusivity within leadership, STEM and revenue generating roles by 2030.

- In the last three years, Sabancı Group appointed 3 women CEOs and 3 women Executive Committee Members. All Group companies have women Board Member at their Board of Directors.

- Sabancı Group’s Social Agenda highlights our keen commitment to making a significant, measurable impact on society.

- Sabancı Volunteers Mobilization project, Sabancı Republic Day Campaign, once again became Türkiye’s most attended social responsibility initiative in 2023.

| 50% women leaders at Holding by 2030 |

8.2% |

13.5% |

30% |

41% |

50% |

50% |

| 50% ratio of women in STEM positions |

- |

33% |

33% |

34% |

33% |

50% |

| 50% ratio of women in revenue generating positions |

- |

43% |

44% |

46% |

50% |

50% |

Outstanding Achievements In CDP Reporting

- Sabancı Holding is the only investment holding from Türkiye in CDP Climate Change Global A List.

We are among the CDP Türkiye Leaders with 9 Sabancı Group companies, 5 of which are on the CDP Global A List.

Sabancı Group Companies Earn Top Ecovadis Medals

- Sabancı Group's industrial companies Kordsa and Brisa earned Gold medals, ranking in the top 5%, while Temsa and Sabancı Group's cement company Çimsa attained Silver medals, placing them in the top 15% across all companies in all industries.

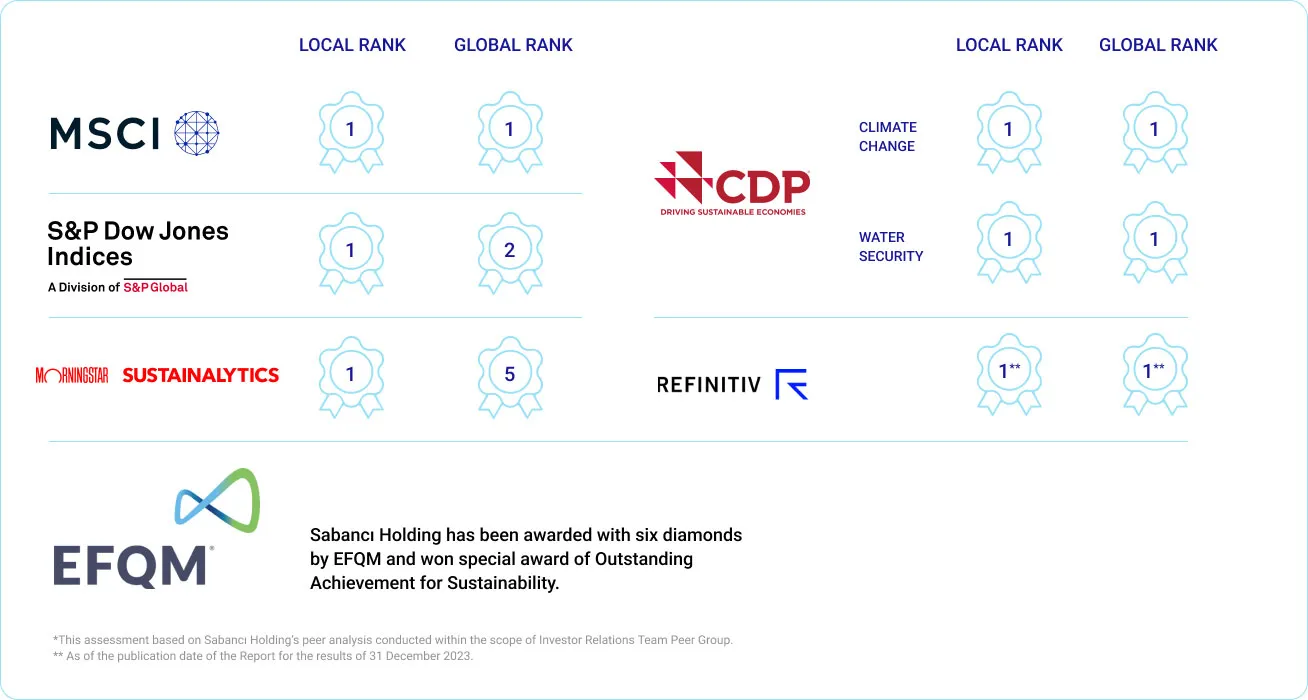

Sabancı Holding’s Stellar Sustainability Performance Recognized Globally

- Our commitment to sustainability and continuous progress is reflected in our 2023 assessments with leadership-level scores by the world's leading ESG rating institutions.

- We received a rating of AA in the MSCI Inc. ESG Ratings assessment which reflects a four notch increase in 4 years.

- We are the first and only conglomerate from Türkiye to be included in the Bloomberg Gender-Equality Index for two consecutive years.

- In the Morningstar Sustainalytics ESG assessment, we were evaluated in the 'Low Risk' category, placing us among the leading companies in the Diversified Financials Category.

- We received a rating of 'A' in the Refinitiv ESG assessment, indicating excellent relative ESG performance and high degree of transparency in reporting material sustainability data publicly among more than 50 companies in the Investment Holding Companies category.

- We are listed in the Borsa İstanbul 25 Sustainability Index, which includes companies in Türkiye with high sustainability performance.

- Sabancı Holding is the only Holding company from Türkiye to be included in the 2024 Sustainability Yearbook of S&P as Sustainability Yearbook Member.

- Sabancı Holding has been awarded with six diamonds by EFQM and won special award of Outstanding Achievement for Sustainability.

We have been ranked the highest amoung our local and global peers.*

Our Stellar Esg Performance Was Recognized Globally

Disclamer: The use by Sabancı Holding of any MCSI ESG research LLC or its affiliates ('MSCI') data, and the use of MSCI logos, trademarks, service marks or index names herein, do not constit ute a sponsorship, endorsement, recommendation, or promotion of Sabancı Holding 3 by MSCI. MSCI services and da ta are the property of MSCI or its information providers, and a re provided ‘as-is’ and without warranty. MSCI names and logos are trademarks or service marks of MSCI.